Investment Management

Parasol

Symbol of Royalty and Protection

Customized Plans that ensure your needs and aspirations are balanced

Each Client is unique.

Personalization in line with your Financial Goals with a 360o approach helps that we deliver sustainable Alpha returns through your journey with us.

Let’s make every rupee earned work harder for you.

The Zen of Investing

‘The Zen of Investing’ is about always keeping a steady mind in “Dynamic Balance” at all times. Combining alertness and calmness in the midst of turbulence, coupled with execution excellence facilitates that your money grows in the optimum way. | KNOW MORE >

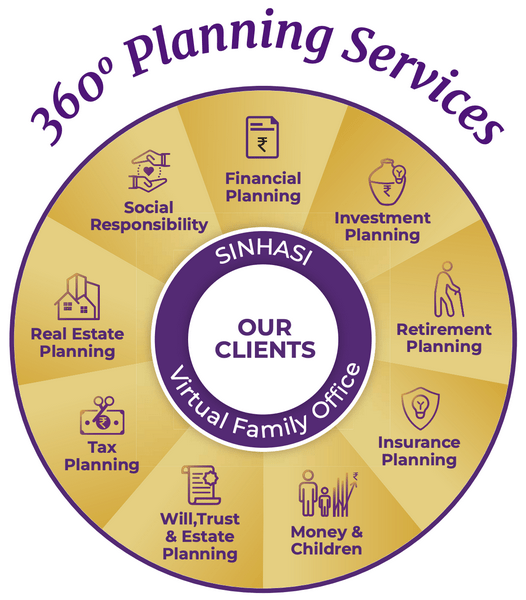

Personalized 360o Wealth Plans

Personalised Wealth Plans are specially prepared for you in line with your Family Goals. We take this very seriously and hence spend time to understand your attitude towards risk and reward, your time horizons, and other key factors that matter to you.

Agile Execution

We curate the right mix of investment solutions, best suitable for you, that enables sustainable Alpha returns, even during turbulent times. We execute on time with service excellence so that never is an opportunity lost.

Client Speak

Mr. Gaurav Gandhi

Vice President – Amazon Prime Video, APAC Singapore

MUMBAI • CLIENT SINCE 2006

“The two most important things when one is taking an investment advice are TRUST and a PERSONALISED approach. One needs to be sure that the advice is unbiased & there is no ulterior motive other than to that maximize returns for the client concerned. One also need to be sure that the advice is customized to the need of the client and the advisory firm understands the client well enough (including the investment psyche & the risk taking ability). Mimi & her team evoke that kind of TRUST and COMFORT for every advise they give their clients – be it in term of investments, insurance or building a corpus for any long term need.”

Client Speak

Client Speak

Mr. Gaurav Gandhi

Vice President – Amazon Prime Video, APAC Singapore

MUMBAI • CLIENT SINCE 2006

“The two most important things when one is taking an investment advice are TRUST and a PERSONALISED approach. One needs to be sure that the advice is unbiased & there is no ulterior motive other than to that maximize returns for the client concerned. One also need to be sure that the advice is customized to the need of the client and the advisory firm understands the client well enough (including the investment psyche & the risk taking ability). Mimi & her team evoke that kind of TRUST and COMFORT for every advise they give their clients – be it in term of investments, insurance or building a corpus for any long term need.”

INVESTMENT PLANNING

Goal Based Planning

Unique personalised wealth plans in line with your family goals.

Some important questions frequently asked are:

- When should I start planning my retirement?

- Should I continue to contribute to EPF?

- How do I get good returns with equity / equity mutual fund investments in such chaotic turbulent times?

- Do I need health insurance if I have a policy from my company?

- Does my health insurance cover covid 19?

- Which is the best life insurance policy to buy?

- Are endowment plans good investment cum life insurance investments?

- Why should I have a joint holder or nominee in my investments?

- I have so many investments. How can I keep track of them?

- I have 4 or 5 bank accounts for separating transactions? Is this good to have?

- Why should I make a will? Is it necessary?

We discuss these questions and help you create your perfect 360o Wealth Plan personalized for you.

Retirement Planning

Grow your money even after you retire, without stress.

Here are some questions we help you plan are?

- Should I settle for such low FD returns @ 5% p.a. pre tax?

- How do I manage my expenses with such low FD returns @5% p.a. before tax?

- How can I manage turbulent Equity returns and handle loss of my capital?

- Is buying real estate or gold a better investment than FDs for my pension?

- Should I invest in Debt Mutual funds for higher returns? Which ones should I choose?

- Will Gold investments give me steady and better returns than FDs?

We at Sinhasi have the expertise to answer all these tough questions and guide you correctly to achieve a stress free retired life with the right mix of assets. Let’s plan your retirement together for sustainable Alpha returns, even during tough times.

Children’s Milestone Planning

Planning for your children and safe guarding their educational and life milestones.

Here are some questions we help plan together-

- When should I start saving for my child’s future?

- How much should I save for my child’s higher education in India or overseas?

- Should I invest in children’s endowment plans for their education?

- Do I need to save for other milestones for my children or should they plan for it?

Our children are most precious to us and we want the best for them, especially when it comes to their education. We help you curate the best investment solutions to achieve your children’s milestones.

Real Estate Purchase Planning

We help you plan your Real Estate Portfolio for to work well for you.

- How do I get good returns from my real estate investments?

- Do I buy or sell real estate now during such turbulent times?

- Can I find a trusted partner to Construct or Renovate my home or office?

Through our partners, we ensure the best of real estate planning and related services.

Asset Allocation

Stay on top of your Investment Portfolio of Financial Assets with Dynamic Balance.

We continuously query your portfolio:

- What is the Right asset allocation for you?

- Do we need to Re-balance your portfolio, especially during such turbulent times?

- Which investments should we say ‘NO’ to? And which ones should we add and keep ?

- How do we continue to make returns on risk-related assets during market turbulence?

| HIGH RISK | LOW RISK |

| Equity / Shares | Bank FD |

| PMS | Corporate FD |

| Equity MFs | Corporate Benefits |

| Gold/Silver/ Commodity | Post Office Schemes |

| Real Estate | Govt and Private Bonds |

| Private Equity | PPF |

| Hedge Fund | Endowment Plan |

| Derivatives | Other Special Structured |

| Art | Guaranteed products |

INSURANCE PLANNING

Plan for good times and bad.

Health Insurance

Protecting your Health the correct way

Basic Health Insurance • Premium Health Insurance

- Do I have health insurance to cover Covid 19?

- Why are some policies cheaper than others, for the same person?

- Why do some companies not re-imburse claims or settle only partial claims?

- Why does health insurance premiums from some companies increase every year?

- What happens when I stop paying my insurance premiums? Can I re-active my policy easily?

- Have I read the fine print of my policy to check what is covered and what is not?

Life Insurance

Protecting Your Family Always

Pure Risk Cover • Legacy Corpus Creation • Investment with Tax Benefits

- Do I really need life insurance?

- What does Human Life Value mean?

- How long should my term or period for an insurance policy be?

- Are term policies better than endowment plans for life cover?

- Are bonuses and returns on insurance policies guaranteed?

- What happens when I stop paying my insurance premiums? Can I re-active my policy easily?

Home Insurance

Protecting Your Home – your most valuable asset

Building Structure • Household Items • Fire & Special Perils • Burglary

- What household items can I insure against theft , fire, and other perils?

- Can I insure my office against theft , fire, and other perils ?

ADDITIONAL SERVICES

Will & Estate

Clear Succession & Inheritance Planning

Registration of Will

Transfers of Investments as per Succession

Real Estate

REIT’s

Real Estate Funds PE Funds

Buy/Sell/Rent/Lease Building

Construction & Renovation

Taxation & Audit

Tax Consultation

Tax Estimation

ITR Filing

Social Responsibility

Donations/Bequeaths to Charitable Causes

Creation of Vehicles/Trust for Charitable Causes